The world is sweet: key trends in confectionery

products | 3 mins read

January 17, 2018

The global confectionery industry is going strong. Although the shift towards ‘better-for-you’ products and clean labels has increased the pressure on manufacturers to reformulate, consumer demand for sweet snacks shows no signs of slowing down. Characterised by a high level of innovation and driven by a desire for comfort and indulgence, the global confectionery market is forecast to record a CAGR of 4.6% until 2021 according to the latest market research from GlobalData.

Let’s take a closer look at the market and some of the key trends that are currently driving product development.

GlobalData insights[1]

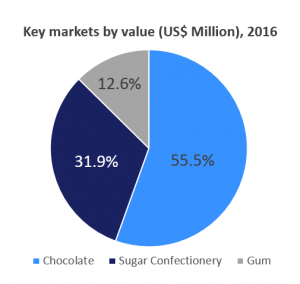

The global confectionery sector was valued at US$156.4 billion in 2016. Mainly dominated by Western Europe, with a 29.6% market share, it’s expected to see some significant growth in Asia-Pacific and Eastern Europe, where it’s forecast to record a CAGR of 7.2% and 5.4% during 2016–2021. An improving global economy and rising disposable incomes in developing countries remain the primary factors enabling consumers to indulge in more quality confectionery products.

Sugar, sugar

It’s not all about chocolate. Sugar confectionery, which globally takes 2nd place in terms of market share (31.9%), has become immensely popular in key growth markets like China, for example, where it accounts for 60% of total confectionery sales. One of the reasons for this is the segment’s high innovation potential. There are so many different ways to innovate with new flavour combinations or textures. Chewy candies like gummies, for example, are incredibly flexible from a production standpoint as flavours, shapes and textures can be easily changed with just a few steps. The results are often some truly unique innovations like kiwi and celery gummies or ginger wasabi marshmallows, which appeal to the adventurous palates of especially the younger consumers.

Super candy

Let’s be honest, candy will always be considered more of an indulgence rather than a healthy treat. However, when enriched with extra nutrients like vitamins, it becomes an excellent carrier of added health benefits. Especially gummies are well suited for the health & wellness segment as any issues related to colour or off-flavour can be easily overcome. The trend towards ‘super candy’ is gaining ground across the world. In 2016, US$3.7 billion worth of confectionery with functional or fortified attributes was sold globally. Leading the trend is Latin America, where over 29.8% of confectionery in the health & wellness segment was positioned as functional/fortified.

The smaller, the better

The global health & wellness trend is not only starting to have an impact on product formulations – sugar content in particular – but it’s also affecting the packaging formats of candy. With a market share of 75.9%, flexible packaging is still by far the most commonly used format in the confectionery segment. In particular, small bags are increasingly popular amongst time-strapped consumers that still want to keep an eye on their waist as they deliver both convenience and portion control. According to a GlobalData survey, 75% of US consumers stated that convenience/portability is important/very important when choosing products to snack on.[2]

A sweet future

The future looks bright for confectionery manufacturers. While reformulation will continue to dominate new product launches over the coming years, the market’s flexibility and willingness to take risks will ensure that the confectionery sector retains its positive growth and innovation potential in the foreseeable future.

If you want to find out how tna can help you maximise the opportunities the market is offering, contact one of our confectionery experts or stop by our booth at ProSweets Cologne, hall 10, stand #G070!

[1] Opportunities in the Global Confectionery Sector, GlobalData (May 2017)

[2] GlobalData Consumer Survey Q4, 2016- US;